Understanding the external context in the complex landscape of business is vital for decision-making and strategic planning. PESTEL Analysis stands out among the multitude of analytical tools to assess these situations due to its extensive strategy, strategic relevance and extensive usage. This article focuses on PESTEL Analysis and its effect on qualitative analysis, strategic decision-making as well as quantitative analysis.

PESTEL Analysis Defined

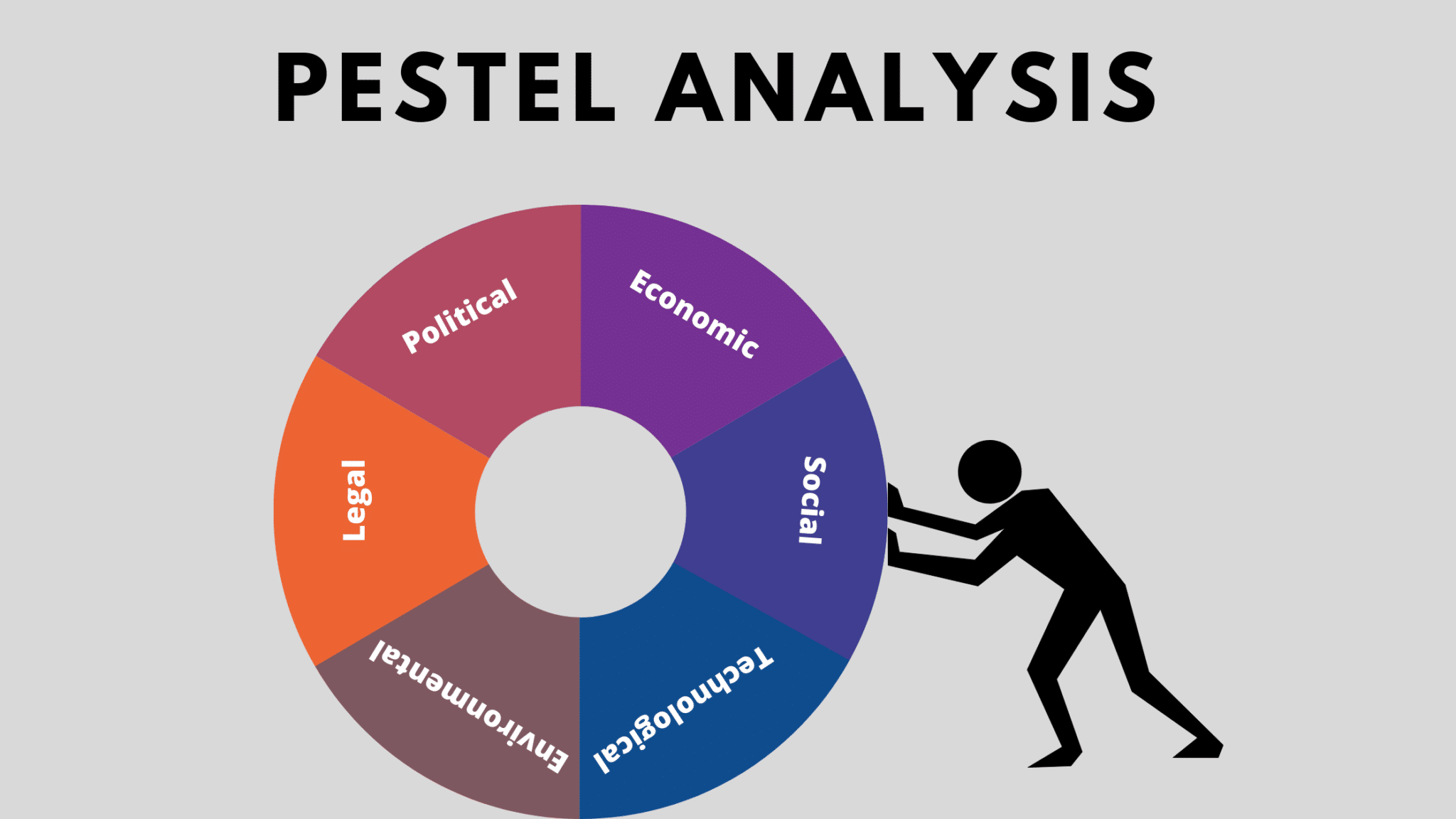

At its core, PESTEL Analysis is a form of qualitative analysis that systematically examines the external factors influencing a business’s operations and performance. The term “PESTEL” stands for Political economic, social, Technological, Environmental and Legal aspects. The six categories include many external influences that can shape the business environment in fundamental ways.

Understanding PESTEL Analysis

The principal goal of PESTEL Analysis is to provide organizations with a holistic comprehension of the macro-environment which they operate. Businesses can analyze the diverse factors that make up each category in order to discover opportunities to grow, innovate and risk mitigation. From the changes in policies of government and economic trends, to changes in the norms of society as well as technological advancements, PESTEL Analysis offers a comprehensive approach to assessing the external context.

Qualitative Analysis and its Role

PESTEL Analysis, unlike traditional financial analysis, which focuses on quantifiable metrics such as profits and revenue (which are not quantifyable) it focuses more on qualitative aspects. Businesses will gain a deeper understanding of the larger environment they operate within by studying factors such as political stability and socio-cultural trends. This method of qualitative analysis is essential for building a solid strategic base and making informed decision-making that is long-term and oriented.

PESTEL Analysis in real life

PESTEL Analysis can serve as an aid for businesses across all industries and sizes. PESTEL Analysis is a vital tool for mergers and acquisitions in order to determine the risk and potential benefits of transactions. Investors can make more informed choices by analyzing the external influences that impact the targeted company as well as the market as a whole.

PESTEL Analysis also plays an crucial role in the formulation of business plans and strategies. Through identifying emerging trends and anticipating future developments businesses can anticipate and adapt their strategies in order to benefit from opportunities and minimize risk. Whether entering new markets, launching new products, or responding to regulatory changes, PESTEL Analysis provides invaluable insights that inform strategic direction and drive sustainable growth.

Integrating PESTEL into Financial Models

PESTEL analysis is vital to financial analysis, however it’s incomplete without qualitative insights. Through the incorporation of PESTEL elements in financial models, analysts can produce more accurate forecasts as well as projections that account for external factors. This integration allows businesses to make better financial decisions with a better appreciation of both internal and external influences.

Conclusion Leveraging PESTEL Analysis to Gain Strategic Advantage

In the end, PESTEL Analysis stands as a powerful tool for understanding and navigating through the complexities of the external business landscape. Companies can make strategic choices based on a better understanding of their operating environment through taking a systematic look at technological, economic and social, legal as well as environmental aspects. PESTEL Analysis helps organizations adapt to the ever-changing world by identifying new opportunities and minimizing risk. PESTEL Analysis, which is used to help guide the strategic plan and to make informed decisions is an indispensable instrument for companies in the face of ever-changing issues and new opportunities.